A pharmaceutical chargeback is very different from a typical chargeback, one that’s very specific to the pharmaceutical industry (as the name suggests) and is part of the regular business practice.

This can get confusing since non-pharmaceutical, traditional chargebacks are typically credited back to a customer because they’re disputing a credit card charge. These are considered a negative process, meaning you want to minimize the number of these you get as a business.

This is simply not the case for pharmaceutical chargebacks. In fact, the more chargebacks you have, the more sales you have of your products.

In today’s guide, we’re exploring what pharmaceutical chargebacks are, what they mean, and everything else you need to know about them.

What is a Pharmaceutical Chargeback?

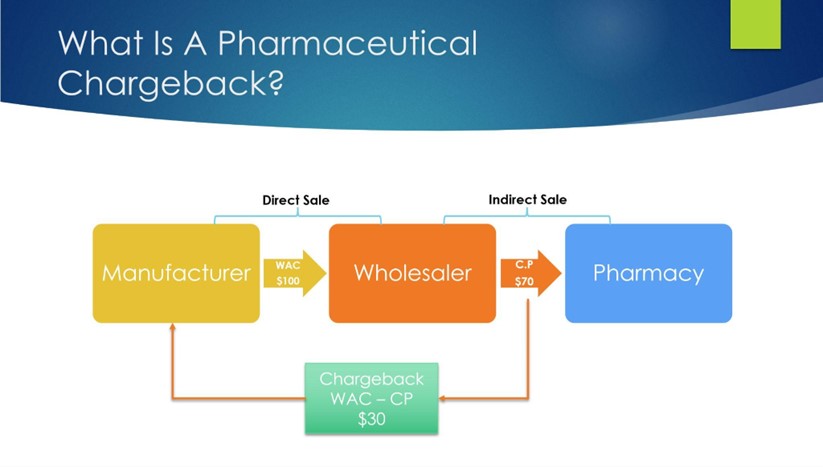

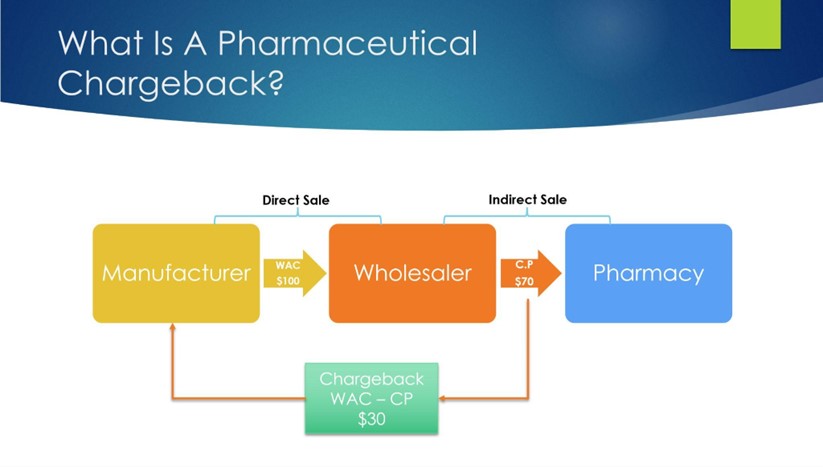

A pharmaceutical chargeback is the difference between the Wholesaler Acquisition Cost (WAC) and the Contract Price. It occurs when a wholesaler sells a pharmaceutical manufacturer’s product to a pharmacy or other entity.

The chargeback amount is calculated by the wholesaler and sent to the pharma manufacturer as a request for credit.

Let’s look at an example.

The pharmaceutical manufacturer sells their product to the wholesaler at WAC ($100).

The wholesaler then sells that product to a pharmacy on one of the manufacturer’s contracts at the Contract Price ($70).

The wholesaler then calculates the chargeback amount ($100 – $70 = $30) and sends that to the pharma manufacturer, requesting a $30 credit.

This $30 is the pharmaceutical chargeback.

Now, that can be a little confusing, so let’s dive deeper into how things work in the pharmaceutical industry, starting with those involved in the process.

The Players Within a Pharmaceutical Chargeback

First, let’s describe the players that are involved with pharmaceutical chargebacks. The main players involved in pharmaceutical chargebacks are:

- Wholesalers (ABC, McKesson, and Cardinal Health)

- Pharmaceutical Manufacturers

- Pharmacies/Purchaser (i.e., Walgreens or CVS)

Wholesalers

In the pharmaceutical industry, three main wholesalers represent more than 90% of all pharmaceutical distribution:

- AmerisourceBergen (now Cencora)

- McKesson Drug

- Cardinal Health

There are some other smaller wholesalers, but most of them are actually owned by one of these three parent companies.

These three wholesalers are giants and tend to dwarf most pharmaceutical manufacturers.

However, for these pharmaceutical manufacturers to get their drugs distributed, they must rely on the presence and business of wholesalers. This is especially true for generic pharmaceutical manufacturers.

Brand pharmaceutical manufacturers tend to have more control because they have exclusivity on the product, but they still need to work with the wholesalers.

Pharmaceutical Manufacturers

Pharmaceutical manufacturers are the actual drug manufacturers developing, manufacturing, and selling the products.

You have generic drug manufacturers, and you have brand drug manufacturers.

Generic drug manufacturers are developing and manufacturing generic drugs that a brand company developed initially, and the patent or exclusivity has run out, enabling other manufacturers to create generic versions of that drug.

Brand manufacturers are developing and selling new drugs. Some of their products still have exclusivity, and some don’t.

Some manufacturers actually develop and sell both brand and generic products.

Pharmacies/Purchasers

In this context, a purchaser is the entity that buys the manufacturer’s product through a wholesaler.

The easiest example to understand would be a pharmacy like Walgreens or CVS; however, the purchaser could also be a hospital, government agency, retail chain, nursing home, etc.

Many pharmacies, no matter how big they are, prefer to purchase through the wholesalers rather than the manufacturer directly.

This allows them to buy only what they need at that time rather than buying in bulk and having to store the inventory, which helps with cash flow and general business management.

This is why more than 90% of the distribution goes through the wholesalers.

However, large pharmacies also have the ability to purchase directly from the manufacturer when desired, providing them with the ultimate flexibility.

A Breakdown of Drug Manufacturer Contracts

In order to sell their products, pharmaceutical manufacturers will establish contracts with both the pharmaceutical wholesalers and the purchasers.

These contracts establish the pricing for each product on the contract as well as which purchasers can buy from that contract.

There are two main types of contracts: direct and indirect.

Direct Contracts

A direct contract contains the pricing information for when a customer buys directly from the manufacturer, known as the direct price.

A direct contract between the wholesaler and the pharma manufacturer defines the WAC price for each product. This is the price the wholesaler will be invoiced by the manufacturer when purchasing their products.

Large pharmacies and retail chains might also establish direct contacts with the manufacturers. This pricing would be used when they buy directly from the manufacturer and not through a wholesaler.

Indirect Contracts

An indirect contract establishes pricing for when a purchaser buys the manufacturer’s product through a wholesaler, known as the indirect price.

Once the contracts are executed, the pharmaceutical manufacturer communicates the contract information to the wholesaler and they load them into their system.

Direct Sales

A direct sale is exactly that – direct.

This means when the manufacturer sells their product to a wholesaler or another customer and sends an invoice to them, that would be a direct sale.

When the manufacturer sells their product to the wholesaler at the WAC price, this is also a direct sale from the manufacturer’s point of view.

Indirect Sales

An indirect sale is when the wholesaler sells the manufacturer’s product to purchasers. This is an indirect sale of the manufacturer’s product, and it’s sold at the pre-negotiated indirect contract price.

The WAC price and the indirect contract price are used in the chargeback calculation.

A Deep Dive into Pharmaceutical Chargebacks

Now that we’ve gone over all of the key players and terms related to a pharmaceutical chargeback, let’s define what it actually is.

Let’s refer back to the diagram;

As you can see, the manufacturer sells their product at the wholesale acquisition cost (WAC) to the wholesaler.

The manufacturer then generates an invoice for that product to the wholesaler.

That bottle gets received by the wholesaler and placed in inventory.

Now, a pharmacy like Walgreens or CVS calls and orders a bottle of that product.

Based on the contract information loaded in the wholesaler’s system, they determine the correct contract price to sell the product at. Then, the wholesaler would send an invoice to the pharmacy for that amount.

An Example of Pharmaceutical Chargebacks in Action

For this example, we’ll assume that the WAC price is $100 per bottle, and we only deal with one bottle.

Let’s assume the contract price is $70.

The key here is that the contract price is lower than the WAC price.

The difference between the WAC price and the contract price is the chargeback amount that will be owed by the manufacturer back to the wholesaler.

This is what’s known as a pharmaceutical chargeback, and again, it’s accepted business practice in the pharmaceutical industry.

So, for our example, we would take the $100 WAC price and subtract the $70 contract price to get a $30 chargeback amount.

The wholesaler then sends this information to the manufacturer and requests credit for the chargeback amount.

I’m sure this is very confusing because it’s the opposite way that it works in other industries.

In most industries, the wholesaler has a lot of buying power and typically buys directly from the manufacturer at a much lower cost than they will sell it at.

In this model, the wholesaler makes their money by marking up the cost of the product.

However, in the pharmaceutical industry, the wholesaler buys products from a manufacturer at a higher price than they sell it.

This seems weird at first, but if you view the wholesaler as the servicer of the manufacturer’s contracts and not a reseller, then it makes more sense.

The chargeback amount that the wholesaler submits to the manufacturer makes them whole. So, they buy a product for $100 and sell it for $70, but then they also get $30 back from the manufacturer.

Based on this alone, the wholesaler is just breaking even for selling the manufacturer’s product.

How Does the Wholesaler Make Money?

Trust me, the pharmaceutical wholesalers are making money.

Even though they may not make money when they sell the product to the pharmacy, they charge the manufacturers admin fees to fulfill these orders.

In this scenario, the wholesaler is really just acting as a servicer for the pharma manufacturer’s contracts.

In addition, pharmaceutical wholesalers have many other fees and charges for the manufacturers to do business with them.

Conclusion

The world of pharmaceutical chargebacks can be complex and confusing to many, but it is standard practice in the pharma industry.

This unique mechanism helps maintain the flow between the leading players – wholesalers, pharmaceutical manufacturers, and pharmacies/purchasers – allowing the distribution of drugs to reach their intended recipients efficiently.

Pharmaceutical chargebacks are in place to help manage pricing differences and assist with contract fulfillment.

When it comes to your own pharmaceutical business, it’s always best to use pharmaceutical chargeback software to help manage your costs and ensure you’re always aware of where your money is coming and going.

For more information on pharmaceutical chargeback software or to see a demo of our EmpowerRM product, please click here.